Accounting & Taxation

Department of CommerceCommerce Vocational is a 3-year Undergraduate course in which students along with their commerce subjects are also trained in multiple fields such as taxation, computer application, insurance, sales and marketing, travel and tourism, etc. Students who are looking forward to enhancing their vocational skills along with regular commerce subjects should opt for B.com vocational. Specialization and diversity are needed in any organisation these days. The vocational courses issue a very application-based curriculum which is required in our education system.

Key Feature

- Offers a strong foundation in core commerce subjects while adding practical skills directly used in accounting and taxation.

- Trains students to understand real-world tax systems, digital accounting tools, and financial documentation through hands-on learning.

- Integrates additional vocational areas like computer applications, insurance, and sales to broaden career opportunities in finance and business sectors.

- Builds job-ready graduates who can confidently contribute to accounting departments, taxation firms, and multi-industry business operations from day one.

Progression: Accounting & Taxation

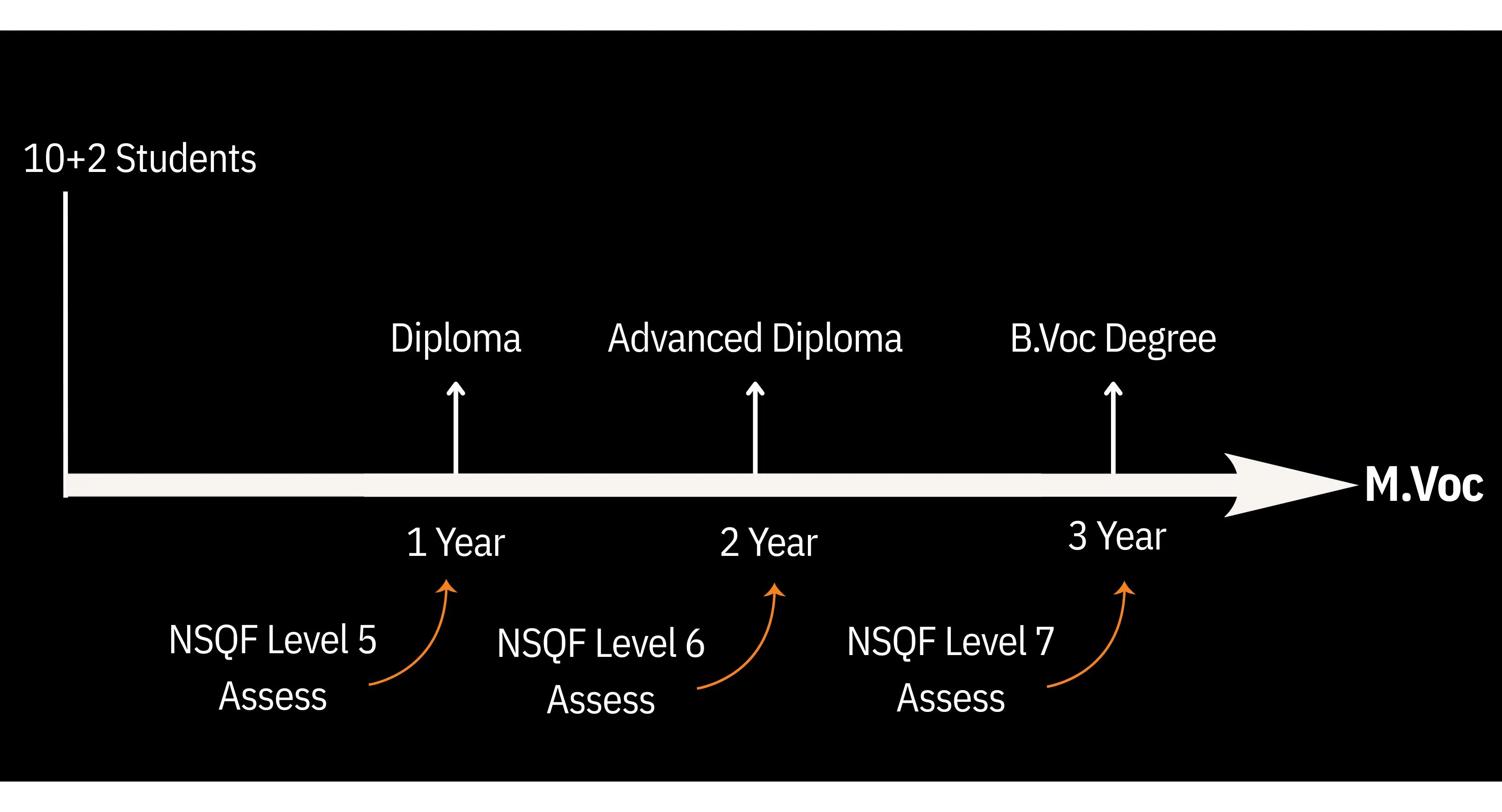

The Accounting & Taxation vocational program at Sikkim Alpine University is designed to help students grow step-by-step from basic accounting knowledge to advanced taxation and financial management skills. The pathway begins right after Class 12 and moves through Diploma, Advanced Diploma, B.Voc Degree, and finally towards M.Voc for higher specialization.

In the Diploma (Year 1 – NSQF Level 5) stage, students build a solid foundation in essential accounting principles, basic income tax concepts, business management basics, and digital skills. This helps them understand how financial records are created, managed, and interpreted in real business environments. Core communication and practical training ensure students gain confidence needed for workplace tasks.

During the Advanced Diploma (Year 2 – NSQF Level 6), learners move into more applied areas of commerce. They explore financial accounting methods, GST fundamentals, introductory Tally accounting, and direct taxation concepts. This level strengthens analytical skills while helping students understand market behaviour, compliance requirements, and real-world financial systems through practical assignments and hands-on sessions.

In the B.Voc Degree (Year 3 – NSQF Level 7), students advance to higher-level professional learning. They work on cost and management accounting, advanced GST, tax planning, company law, payroll accounting, digital literacy, income tax return preparation, and industry-based project work. This final stage prepares them for specialized roles in accounting firms, taxation consultancies, corporate finance departments, and entrepreneurial ventures.

After completing the B.Voc program, students can seamlessly progress to M.Voc, where they further enhance their expertise for leadership, consultancy, teaching, or advanced professional roles in the financial and taxation sector.

This structured progression ensures students develop job-ready skills, practical experience, and strong industry relevance at each stage—making Sikkim Alpine University an excellent choice for those aiming to build a successful career in Accounting, Taxation, Finance, and Business Administration.